With the recent XRP news, some of you may find yourselves regretting not holding some XRP, or trying to get in with every hot garbage that you see is pumping hard or is being shilled hard by your favorite influencers.

The problem with this is, you are experiencing a common mistake that can easily be avoided with a couple of steps I'll outline in this newsletter.

This mistake is what we call Fear of Missing Out or FOMO for short.

Majority of traders FOMO into a trade because they think that this is their ONCE IN A LIFETIME chance to buy certain coins that will lead to GENERATIONAL WEALTH—but that is often NOT the case.

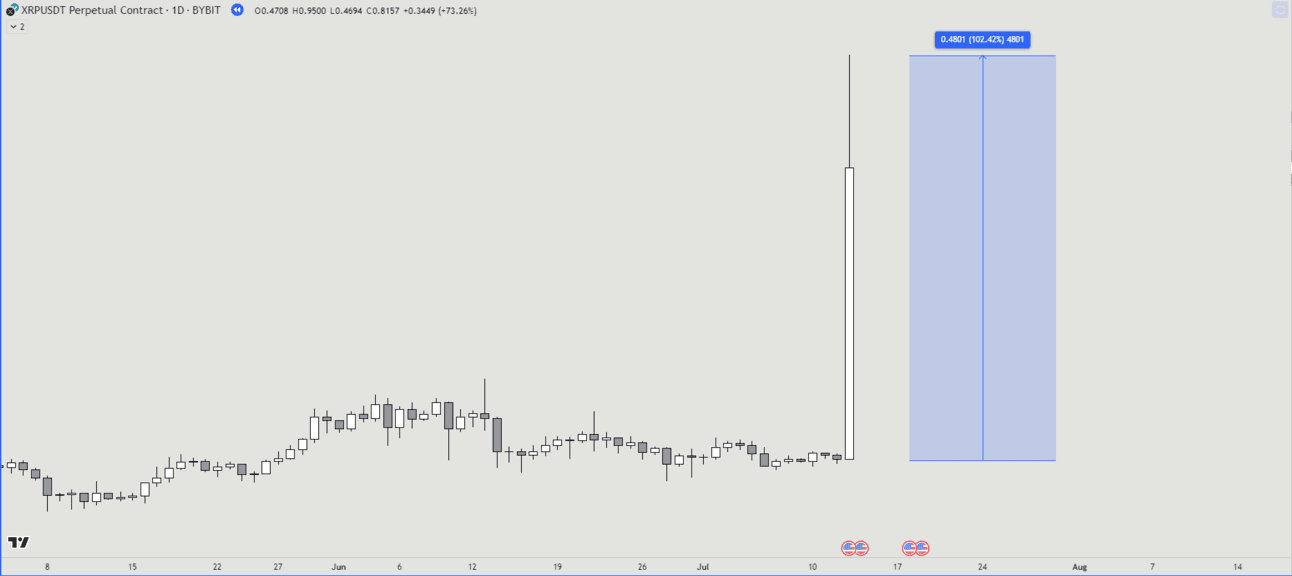

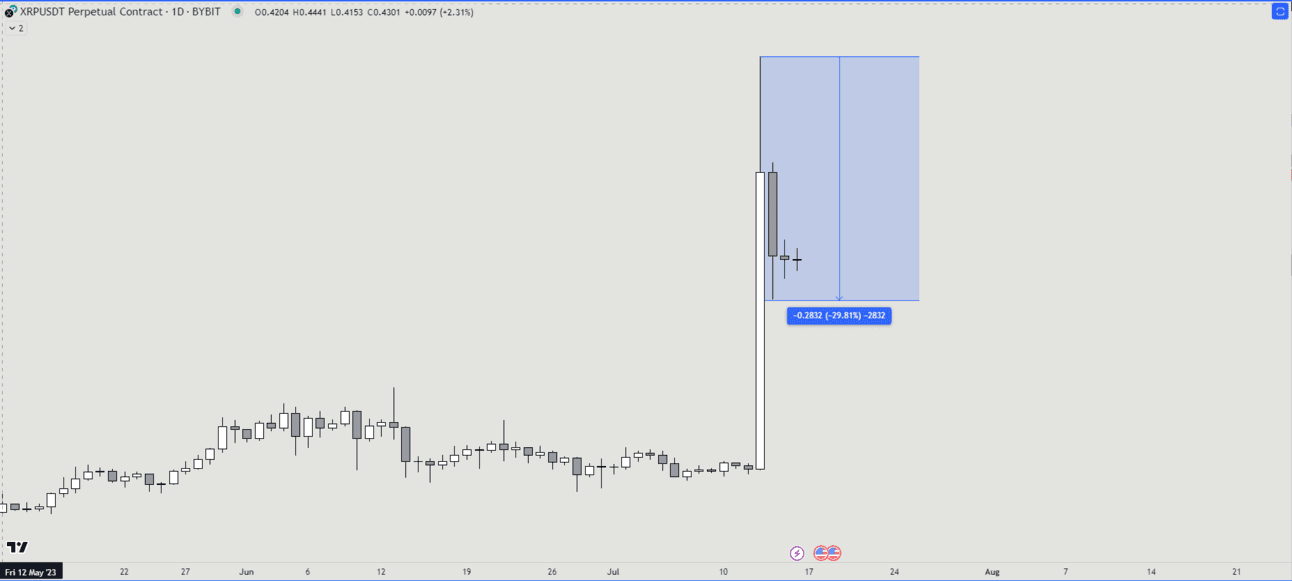

Let’s look at this chart (XRP):

XRP did pump 100% in just 1 day, heck most of the pump occurred within a shorter period of time, say 4 hours.

During this time, we often see a plethora of people flexing their PnL cards from whatever exchange they're trading with, further causing FOMO for other people.

But what we don’t hear about are the majority of people who bought at the top.

Most of the coins that pumped now have a nasty wick which is probably where most people bought in and now, they’d be quite underwater.

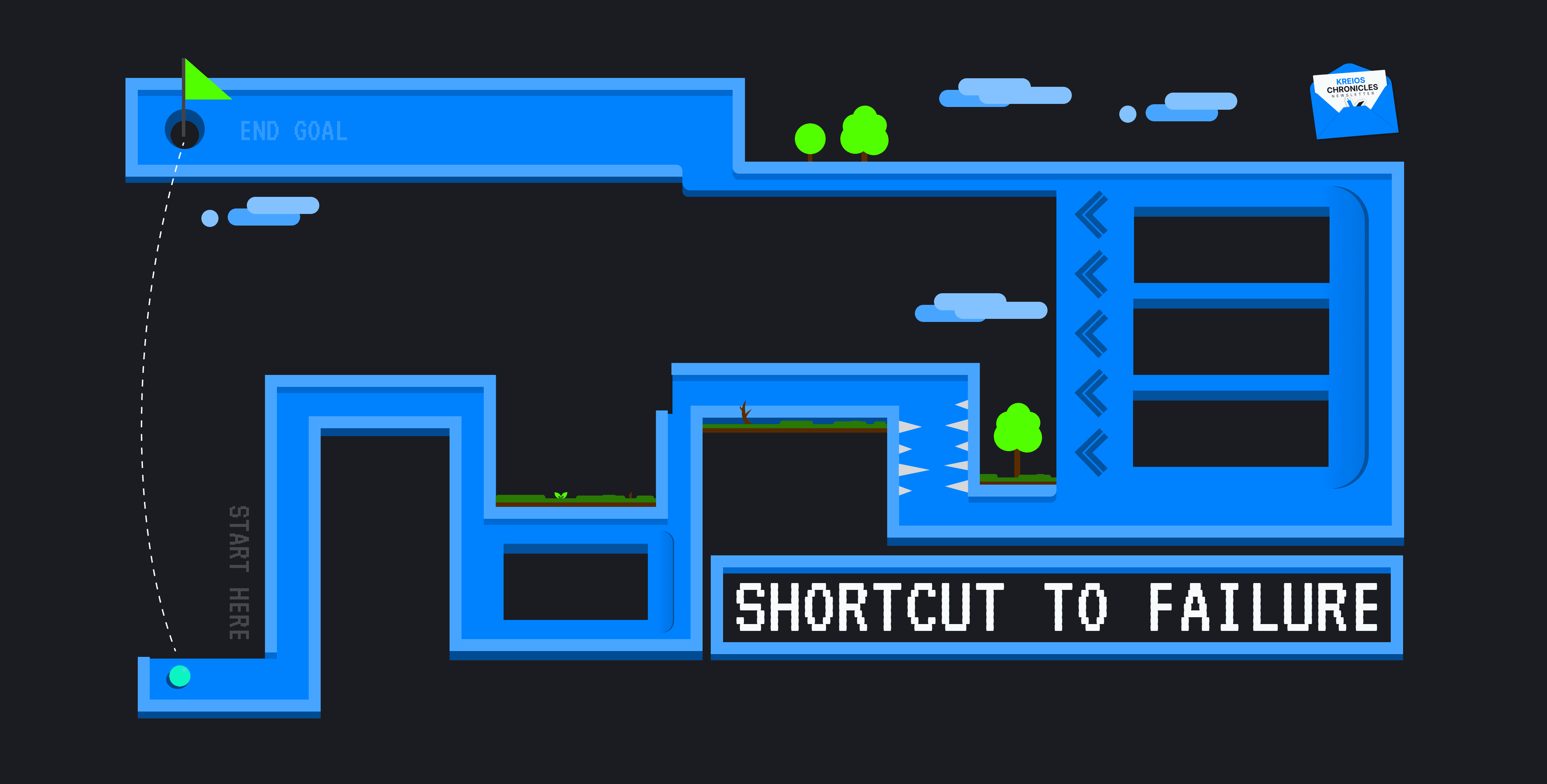

However, this kind of trade is not just your normal loss, it’s a worse one.

Why? Because this kind of trade that was initiated WITHOUT a plan would most likely not have a plan as well with regards to exiting.

Meaning, most people will just keep hoping that it will go back to their initial buying price and ignore other flashing warning signs OR will just exit until the loss is too much to bear and that’s at the point where the damage is probably quite significant already.

Trading like this can bring in quick profits for some but for the rest, coupled with non-existent risk management, it is a sure way to blow your account to pieces.

So, going back to the point of this newsletter, how do we effectively solve this common mistake among traders?

I’m gonna teach you a very simple three-step process on how to combat this dangerous emotion.

Let’s start off with a quote from Michael Carr.

Don’t worry about what the markets are going to do; worry about what you will do in response to the markets.

Remember, you have NO control on what the markets are gonna do but you have all the control on what you’re gonna do as response to the markets.

Understand that there is an infinite amount of opportunities in the market.

First and foremost like most problems, we have to understand WHY the problem occurs in the first place.

Is it because you perceive these trades as easy money?

Is it because you think that there won’t be other opportunities to capitalize on?

Is it because you see a lot of people winning and yet you aren’t which makes you think you need to take action?

Ask yourself questions like these and dig deeper on why you felt that initial FOMO in the first place.

After asking yourselves the primary reasons, slowly talk to yourself and think about why these assumptions aren’t necessarily true.

On any given day or week or month or year, there are SO MANY opportunities for you to capitalize on depending on what kinds of trade you take.

So, why do you have to take a trade based on a feeling of wanting to take a trade when you know you can take trades that you are used to taking?

Have a solid trading plan.

In reality, most people don’t have a trading plan.

I mean it’s very boring to sit and think and create a plan—like why don’t we just trade right? Dead wrong.

Just imagine like any other profession doing their profession without a plan.

Imagine hiring someone to build and design your house based on their feelings.

What could go wrong right? ¯\_(ツ)_/¯

Now in the beginning, your plan won’t be as detailed and as robust as possible and that’s perfectly fine, it’s still better than the gambling most people do.

For now let’s stick to having the basic ingredients of a trading plan. In the future I’m gonna write a more detailed newsletter or conduct a webinar on this topic, so stay tuned for that.

First, define a setup.

What do you want to see?

What conditions should be present?

You CANNOT WAIT for a setup that you clearly have not defined, the same way you cannot wait for your GRAB car without knowing the car model and the license plate, right?

There must be CLARITY in what exactly you are looking for otherwise, everything will look and feel the same.

This concept is quite similar to the concept of “Maslow’s Hammer”, which states that:

If the only tool you have is a hammer, you tend to see every problem as a nail.

So, if you don’t have a clearly defined setup, everything will look like a setup.

We want to avoid this.

However, having a clearly defined setup is NOT enough, you also have to have some sort of rules on how to manage after being in the trade.

Where should you take profits - removing all the greed aside?

When should you cancel the trade idea?

Where do you call it a day and take the loss?

Stick to the plan.

Now that you have a plan albeit not very perfect and robust, you have to stick with it.

There’s NO POINT in making a plan that you won’t follow.

The plan WILL change and MUST change but that has to be done in a systematic way backed with data and logic.

So, the next time you take a trade, pull up your plan and ask yourself slowly the criteria you need to be looking for, and check whether that certain setup is actually a valid one.

If so, take it. If not, leave it.

This is easier said than done but remember, as I mentioned in the first step, there are so many opportunities, hindi ka mauubusan ;)

BONUS TIP: Verbalize reasons when you are taking the trade.

If you really want to go above and beyond, verbalize and record yourself before taking a trade and while being in a trade. You will learn a lot about yourself and your thoughts in the process.

Have an amazing week,

TraderKreios